How to Use Paytm from the USA in 2024

Introduction to Paytm and its services

Paytm is a leading digital payment platform that allows users to make secure and convenient transactions from the comfort of their own homes. With its user-friendly interface and robust security measures, Paytm has gained widespread popularity in India and around the world. This article will guide you on how to use Paytm from the USA and unlock the convenience it offers.

Paytm offers a range of services that go beyond just money transfers. Whether you want to pay your bills, shop for groceries, or recharge your phone, Paytm has got you covered. The platform also offers a seamless integration with various merchants, making it easy to make transactions at online and offline stores.

The benefits of using Paytm from the USA are numerous. Firstly, it allows for quick and hassle-free money transfers to your loved ones in India. No more dealing with long wait times and high transaction fees. Paytm ensures that your money is transferred to your desired recipient within minutes.

Additionally, Paytm offers cashback and rewards programs, giving you the opportunity to save even more on your transactions. By using Paytm, you can access exclusive deals and discounts that you won’t find elsewhere.

Setting up a Paytm account from the USA is a straightforward process. Simply follow the step-by-step guide provided in this article and you’ll be ready to start using Paytm in no time. So why wait? Sign up for Paytm today and experience the convenience and benefits it offers.

Understanding Paytm’s background and evolution

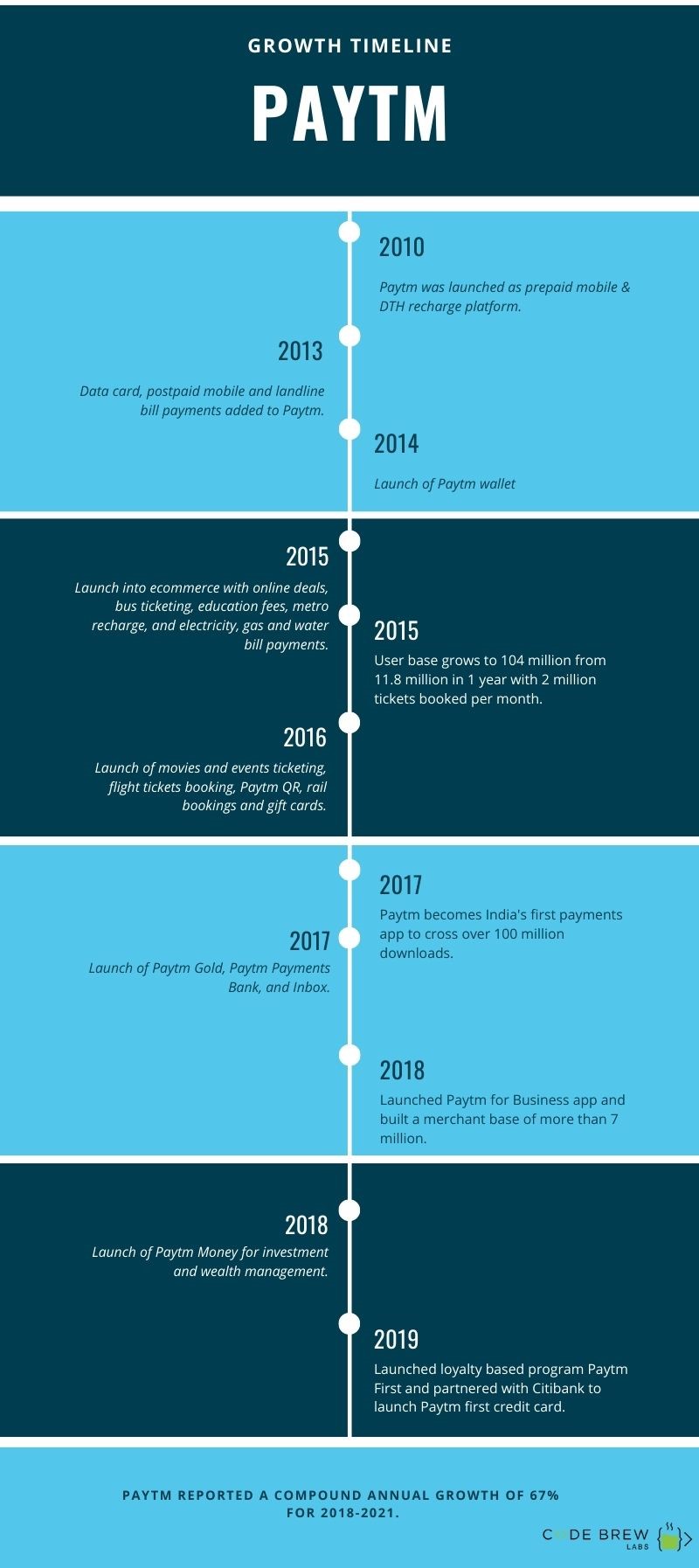

Paytm has come a long way since its inception in 2010. Founded by Vijay Shekhar Sharma, the company initially started as a platform offering direct-to-home (DTH) and prepaid mobile services. With a modest startup funding of $2 million, Paytm began its journey towards revolutionizing digital payments in India.

Over the years, Paytm has grown exponentially and expanded its services to become one of the leading digital payment platforms in the country. The company’s success can be attributed to its innovative approach and commitment to providing convenient and secure payment solutions.

In 2014, Paytm received a major boost when it secured funding from Alibaba Group and its affiliate Ant Financial, which further accelerated its growth. This partnership allowed Paytm to enhance its technology infrastructure and improve user experience.

One of the key milestones in Paytm’s evolution was the demonetization drive in India in 2016. The government’s decision to invalidate high-value currency notes led to a surge in digital payments, with Paytm emerging as the go-to platform for millions of people to make cashless transactions.

Paytm’s success story continued as it launched several new features and services, including bill payments, online shopping, money transfers, and even financial services like wealth management and insurance. The platform’s user base grew rapidly, reaching over 350 million users in a short span of time.

Today, Paytm is not just a payment platform but a comprehensive ecosystem that caters to the diverse needs of its users. With constant innovation and a customer-centric approach, Paytm continues to evolve and redefine the way people transact and manage their finances in India.

By understanding Paytm’s background and evolution, users can appreciate the platform’s journey and gain confidence in using it for their daily payment needs.

Benefits of using Paytm for transactions in the USA

Paytm offers a range of benefits for individuals looking to make transactions in the USA. Here are some key advantages of using Paytm for your financial needs:

- Convenience: Paytm provides a convenient and user-friendly platform for making transactions from the comfort of your own home. Whether you want to pay bills, shop online, or transfer money to friends and family, Paytm offers a seamless experience with just a few taps on your phone.

- Wide Acceptance: Paytm has established partnerships with a large number of merchants and service providers in the USA, making it widely accepted across various industries. This means you can use Paytm for a diverse range of transactions, from paying for groceries to booking flights.

- Secure Payments: Paytm prioritizes the security of your financial information. With advanced encryption technology and secure payment gateways, Paytm ensures that your transactions are protected against fraud and unauthorized access.

- Competitive Exchange Rates: When sending money from the USA to other countries, Paytm offers competitive exchange rates, ensuring that you get the most value for your money. This can be particularly beneficial when making international transfers or sending remittances to loved ones.

- Cashback and Rewards: Paytm frequently offers cashback and rewards programs, providing users with the opportunity to earn additional savings and benefits. By using Paytm for your transactions, you can take advantage of these offers and enjoy extra perks.

- Responsive Customer Support: Paytm provides responsive and helpful customer support to assist users with any queries or concerns. Whether you have questions about your account, transactions, or technical issues, Paytm’s customer service team is available to provide assistance.

In conclusion, using Paytm for transactions in the USA offers a range of benefits, including convenience, wide acceptance, security, competitive exchange rates, cashback and rewards, and responsive customer support. With these advantages, Paytm provides a reliable and efficient platform for managing your financial transactions.

Setting up a Paytm account

To begin using Paytm from the USA, you will need to set up a Paytm account. Follow these step-by-step instructions to easily create your Paytm account and start enjoying its services:

- Visit the Paytm website or download the Paytm app on your mobile device.

- Click on the “Sign Up” or “Create Account” button to begin the registration process.

- Enter your mobile number and email address. Make sure to provide a valid email address as it will be used for account verification and communication.

- Create a secure password for your Paytm account. Make sure to choose a strong password that includes a combination of letters, numbers, and special characters.

- Once you have entered the required information, click on the “Continue” or “Next” button to proceed.

- You will receive an OTP (One-Time Password) on your registered mobile number for verification. Enter the OTP in the designated field to verify your account.

- After successful verification, you will be prompted to provide additional details such as your name, date of birth, and address. Fill in the required information accurately.

- Review the terms and conditions of Paytm and click on the “Agree” or “Accept” button to complete the account setup process.

- Congratulations! Your Paytm account is now set up and ready to use. You can now add funds to your wallet, make bill payments, shop online, and enjoy the various services offered by Paytm.

Remember to keep your login credentials confidential and avoid sharing them with anyone. It’s also recommended to enable two-factor authentication for added security.

By following these simple steps, you can easily create a Paytm account and start taking advantage of its convenient and secure features.

Step-by-step guide to creating a Paytm account from the USA

Creating a Paytm account from the USA is a simple process that allows you to access and enjoy the convenient services offered by Paytm. Follow these step-by-step instructions to easily create your Paytm account:

- Visit the Paytm website or download the Paytm app on your mobile device.

- Click on the “Sign Up” or “Create Account” button to begin the registration process.

- Enter your mobile number and email address. Make sure to provide a valid email address as it will be used for account verification and communication.

- Create a secure password for your Paytm account. It is important to choose a strong password that includes a combination of letters, numbers, and special characters.

- Once you have entered the required information, click on the “Continue” or “Next” button to proceed.

- You will receive an OTP (One-Time Password) on your registered mobile number for verification. Enter the OTP in the designated field to verify your account.

- After successful verification, you will be prompted to provide additional details such as your name, date of birth, and address. Fill in the required information accurately.

- Review the terms and conditions of Paytm and click on the “Agree” or “Accept” button to complete the account setup process.

- Congratulations! Your Paytm account is now set up and ready to use. You can now add funds to your wallet, make bill payments, shop online, and enjoy the various services offered by Paytm.

Remember to keep your login credentials confidential and avoid sharing them with anyone. It is also recommended to enable two-factor authentication for added security.

By following these simple steps, you can easily create a Paytm account and start taking advantage of its convenient and secure features.

Verifying your Paytm account and linking payment methods

After successfully creating your Paytm account, the next step is to verify your account and link your preferred payment methods. Verifying your Paytm account ensures that your transactions are secure and helps prevent unauthorized access. Here’s how you can verify your Paytm account and link your payment methods:

- Account Verification: To verify your Paytm account, you will need to provide some additional information and complete the verification process. This may involve submitting documents such as your government-issued ID proof and address proof. Paytm may also require you to complete a video call verification to confirm your identity.

- Linking Payment Methods: Once your account is verified, you can link your preferred payment methods to your Paytm account. Paytm supports various payment options including bank accounts, credit cards, and debit cards. To link a payment method, go to your Paytm account settings and select the “Payment Options” or “Add Payment Method” option. Follow the prompts to enter the necessary details and securely link your preferred payment method.

- Security Measures: Paytm takes the security of your payment information seriously. They use advanced encryption and security protocols to protect your sensitive data. Additionally, Paytm offers two-factor authentication for added security. Enable this feature in your account settings to receive a verification code (OTP) on your registered mobile number whenever you make a transaction.

By verifying your Paytm account and linking your payment methods, you can enjoy a seamless and secure payment experience. You will be able to make transactions conveniently and confidently, knowing that your financial information is protected.

Exploring Paytm features and services

When using Paytm from the USA, it’s important to familiarize yourself with the various features and services it offers. Paytm is not just a digital wallet; it provides a wide range of options to cater to your diverse financial needs.

One of the key features of Paytm is its bill payment facility. Whether it’s utility bills, mobile recharges, or credit card payments, Paytm allows you to conveniently settle all your bills in one place. You can also schedule recurring payments for added convenience.

Paytm also serves as a platform for shopping. With a vast range of products available, you can explore different categories and make purchases using your Paytm wallet. The platform also offers exclusive deals and discounts, ensuring that you get the best value for your money.

Transferring money to friends and family is made easier with Paytm. Whether it’s sending money to someone’s Paytm wallet or transferring to their bank account, you can do it seamlessly within the app. Plus, you can also use Paytm for easy and secure fund transfers to various UPI (Unified Payments Interface) addresses.

Paytm rewards its users through its cashback system. By making transactions on Paytm, you can earn cashback that can be used towards future purchases or transferred to your bank account. Keep an eye out for special promotions and offers to maximize your savings.

Additionally, Paytm provides access to a mini store, where you can order medicines, consult doctors, and access various lifestyle services, all within the app. This added convenience makes Paytm a one-stop solution for all your needs.

By exploring and utilizing the various features and services of Paytm, you can make the most of your experience and enjoy seamless transactions, shopping, bill payments, and more, all from the comfort of your home in the USA.

Overview of Paytm’s bill payment, shopping, and transfer options

Paytm offers a wide range of services to cater to your diverse financial needs. One of the key features of Paytm is its bill payment facility. Whether it’s utility bills, mobile recharges, or credit card payments, you can conveniently settle all your bills in one place. Paytm allows you to schedule recurring payments, ensuring that you never miss a due date.

In addition to bill payments, Paytm serves as a platform for shopping. With a vast range of products available, you can explore different categories and make purchases using your Paytm wallet. The platform also offers exclusive deals and discounts, ensuring that you get the best value for your money. From electronics to clothing, beauty products to home essentials, Paytm has it all.

Transferring money to friends and family is made easier with Paytm. Whether it’s sending money to someone’s Paytm wallet or transferring to their bank account, you can do it seamlessly within the app. Plus, you can also use Paytm for easy and secure fund transfers to various UPI (Unified Payments Interface) addresses.

When it comes to safety and security, Paytm provides SSL encryption and two-factor authentication to protect your transactions. Your financial information is kept confidential, giving you peace of mind while using the platform.

Overall, Paytm offers a comprehensive range of services, including bill payments, shopping, and money transfers. With its user-friendly interface and secure transactions, Paytm ensures a seamless and convenient experience for users in the USA. So whether you need to pay bills, shop for essentials, or send money to loved ones, Paytm is your one-stop solution.

Understanding Paytm’s rewards and cashback system

Paytm offers a rewards and cashback system that allows users to earn points and receive discounts on their transactions. This system provides users with additional benefits and incentives for using Paytm for their financial transactions.

To start earning rewards and cashback on Paytm, you need to participate in the rewards program. Open the Paytm app and scroll down to the “Cashback & Offers” section. Here, you can explore various offers and promotions available on different products and services.

When you make a qualifying transaction on Paytm, you earn points based on the transaction value. These points can be redeemed for various rewards like subscriptions, brand deals, gift vouchers, and even converted to Paytm balance. The more transactions you make, the more points you can accumulate.

Paytm also regularly offers cashback on specific transactions or categories. This means that you can receive a percentage of the transaction value back as cashback. The cashback is usually credited to your Paytm wallet and can be used for future transactions.

It’s important to note that the terms and conditions for earning rewards and cashback may vary for different offers. Make sure to carefully read the details and requirements of each offer before participating.

By taking advantage of Paytm’s rewards and cashback system, you can save money and maximize the value of your transactions. So, make sure to keep an eye out for the latest offers and promotions to enjoy the benefits of using Paytm.

Making secure transactions on Paytm

When using Paytm for transactions, it’s essential to prioritize security and protect your personal and financial information. Follow these tips to ensure secure transactions on Paytm from the USA:

- Update your Paytm app: Regularly update the Paytm app on your device to ensure you have the latest security features and bug fixes.

- Enable two-factor authentication: Activate two-factor authentication for your Paytm account to add an extra layer of security. This will require you to enter a unique OTP (One-Time Password) sent to your registered mobile number for every transaction.

- Use strong and unique passwords: Create a strong password for your Paytm account that includes a combination of letters, numbers, and symbols. Avoid using common or easily guessable passwords. Consider using a password manager to generate and store unique passwords for all your online accounts.

- Be cautious of phishing attempts: Be wary of suspicious emails, messages, or calls that ask for your Paytm login credentials or personal information. Paytm will never ask you for your password or OTP in an unsolicited communication. Avoid clicking on suspicious links or providing your information to unknown sources.

- Verify the recipient’s details: Before making a payment, double-check the recipient’s details, such as their mobile number or UPI ID. Paytm allows you to verify the recipient’s profile information to ensure you are sending money to the correct person.

- Secure your device: Install reliable antivirus software on your device and keep it up to date. Avoid using public Wi-Fi networks when making financial transactions on Paytm, as they may not be secure.

By following these best practices, you can have peace of mind while making transactions on Paytm from the USA. Remember to stay vigilant and report any suspicious activities to Paytm customer support immediately. Prioritizing security will help you enjoy a seamless and protected experience on the platform.

Tips for ensuring secure transactions on Paytm from the USA

When using Paytm for transactions from the USA, it’s crucial to prioritize security and protect your personal and financial information. Here are some tips to ensure secure transactions on Paytm:

- Update your Paytm app: Regularly update the Paytm app on your device to ensure you have the latest security features and bug fixes. This will help to safeguard your transactions from potential vulnerabilities.

- Enable two-factor authentication: Activate two-factor authentication for your Paytm account to add an extra layer of security. This will require you to enter a unique OTP (One-Time Password) sent to your registered mobile number for every transaction. It ensures that only you can authorize transactions on your account.

- Use strong and unique passwords: Create a strong password for your Paytm account that includes a combination of letters, numbers, and symbols. Avoid using common or easily guessable passwords. Consider using a password manager to generate and store unique passwords for all your online accounts.

- Be cautious of phishing attempts: Be wary of suspicious emails, messages, or calls that ask for your Paytm login credentials or personal information. Paytm will never ask you for your password or OTP in an unsolicited communication. Avoid clicking on suspicious links or providing your information to unknown sources.

- Verify the recipient’s details: Before making a payment, double-check the recipient’s details, such as their mobile number or UPI ID. Paytm allows you to verify the recipient’s profile information to ensure you are sending money to the correct person.

- Secure your device: Install reliable antivirus software on your device and keep it up to date. Avoid using public Wi-Fi networks when making financial transactions on Paytm, as they may not be secure.

By following these best practices, you can have peace of mind while making transactions on Paytm from the USA. Remember to stay vigilant and report any suspicious activities to Paytm customer support immediately. Prioritizing security will help you enjoy a seamless and protected experience on the platform.

Managing your account and protecting personal information

As a Paytm user from the USA, it is essential to effectively manage your account and take measures to protect your personal information. Here are some important steps you can take to ensure the security of your Paytm account:

- Regularly monitor your account: Keep a close eye on your account activity and review your transaction history frequently. Report any suspicious or unauthorized transactions to Paytm customer support immediately.

- Update your contact information: It is crucial to provide accurate and up-to-date contact information, such as your email address and mobile number. This ensures that you receive important account notifications and can be contacted in case of any issues.

- Opt for secure login options: Enable biometric authentication or a secure PIN to access your Paytm account. This adds an extra layer of security and prevents unauthorized access.

- Avoid sharing your personal information: Be cautious while sharing any personal or financial information online. Paytm will never ask you for your password, PIN, or OTP (One-Time Password) in an unsolicited communication. Be wary of phishing attempts and fraudulent requests for information.

- Set up transaction alerts: Activate transaction alerts for your Paytm account. This way, you will receive immediate notifications for any transactions made from your account, allowing you to identify and report any unauthorized activity promptly.

- Keep your device secure: Ensure that your device has updated antivirus software installed. Avoid downloading apps or files from unknown sources, as they may contain malware that can compromise the security of your Paytm account.

By proactively managing your Paytm account and following these security measures, you can protect your personal information and ensure a secure experience while using the platform. Remember to always be vigilant and report any suspicious activities to Paytm customer support.

Paytm customer support and assistance

When using Paytm from the USA, it is important to know that you have access to reliable customer support and assistance whenever you need it. Paytm offers various channels for users to reach out and get their queries resolved or seek assistance.

To contact Paytm customer support, you can follow these steps:

- Open the Paytm app and go to the “Help & Support” section.

- Select the category that best matches your query or concern.

- Browse through the frequently asked questions (FAQs) or search for specific keywords related to your issue.

- If you cannot find a solution, click on the “Message Us” option.

- You can now chat with a Paytm customer support representative in real-time and receive personalized assistance.

It is important to provide clear and concise information regarding your query to get the most accurate and efficient resolution.

Common issues that can be addressed by Paytm customer support include transaction failures, account verification, refund requests, and general app usage queries. The customer support team is trained to handle a wide range of issues and assist you in a prompt and professional manner.

Additionally, Paytm also has an extensive knowledge base and community forum where users can find answers to commonly asked questions and engage with other Paytm users.

Remember, it is always recommended to reach out to Paytm’s official customer support channels and avoid sharing personal or account-related information with anyone who claims to be a Paytm representative outside of these channels.

By leveraging Paytm’s customer support and assistance, you can address any concerns or issues that arise while using Paytm from the USA and have a smooth and trouble-free experience.

How to reach Paytm customer service for queries and assistance

When you have queries or require assistance while using Paytm from the USA, you can easily reach out to Paytm’s customer service for prompt and reliable support. Paytm offers various channels through which you can connect with their customer support team. Here are the steps to reach Paytm customer service:

- Open the Paytm app on your device and go to the “Help & Support” section. This can usually be found in the menu or settings of the app.

- Once you are in the “Help & Support” section, you will find different categories related to common queries and issues. Choose the category that best matches your query or concern.

- Browse through the frequently asked questions (FAQs) related to the category you have selected. Paytm provides comprehensive FAQs that may have the answers to your queries.

- If you are unable to find a solution in the FAQs, you can click on the “Message Us” option. This will allow you to chat with a Paytm customer support representative in real-time.

- During the chat, provide clear and concise information about your query or issue to receive the most accurate and efficient resolution.

Paytm’s customer support team is trained to handle a wide range of issues, including transaction failures, account verification, refund requests, and general app usage queries. They strive to provide prompt and professional assistance to ensure a smooth experience for their users.

In addition to the in-app customer support chat, Paytm also has an extensive knowledge base and community forum where you can find answers to commonly asked questions and engage with other Paytm users.

Remember, it is always recommended to reach out to Paytm’s official customer support channels and avoid sharing personal or account-related information with anyone who claims to be a Paytm representative outside of these channels. By leveraging Paytm’s customer support and assistance, you can address any concerns or issues that arise while using Paytm from the USA and have a smooth and trouble-free experience.

Common issues faced when using Paytm from the USA and their solutions

When using Paytm from the USA, you may encounter some common issues. However, there are solutions available to help you overcome these challenges and ensure a smooth experience.

One common issue is difficulties in linking international credit or debit cards to your Paytm account. Paytm primarily supports Indian bank accounts and cards, so it may not be possible to link your international cards directly. In such cases, you can consider using a virtual payment platform like PayPal to add funds to your Paytm wallet.

Another issue you might face is currency conversion. Paytm primarily operates in Indian Rupees (INR), and if you are making transactions in a different currency, there may be conversion fees or discrepancies in exchange rates. To overcome this, it is recommended to have a clear understanding of the conversion rates and any associated charges before proceeding with your transactions.

Transaction failures can also occur, especially when making international payments. If you encounter a failed transaction, ensure that you have sufficient funds in your Paytm wallet or linked bank account. If the issue persists, you can reach out to Paytm’s customer support for assistance in resolving the matter.

Lastly, if you have any concerns or issues regarding the security of your Paytm account, it is advisable to enable two-factor authentication and regularly update your password. This will help protect your account from unauthorized access and ensure the security of your transactions.

By being aware of these common issues and their corresponding solutions, you can navigate your Paytm experience from the USA more effectively and enjoy the convenience and benefits that Paytm offers. Remember to reach out to Paytm’s customer support for additional guidance and assistance, as they are dedicated to providing reliable support to their users.

Conclusion

In conclusion, Paytm provides a reliable and convenient platform for users in the USA to make transactions and enjoy various services. Setting up a Paytm account is straightforward, and by following the step-by-step guide, you can easily create an account and link your preferred payment methods. Paytm offers a range of features and services, including bill payments, online shopping, and easy fund transfers, making it a one-stop solution for all your financial needs.

When using Paytm from the USA, it is important to ensure the security of your transactions. By following the provided tips, such as regularly updating your password and enabling two-factor authentication, you can enhance the safety of your Paytm account and protect your personal information.

If you encounter any issues or have questions regarding your Paytm account, their customer support is readily available to assist you. You can easily reach out to them for queries, assistance, or to resolve any problems you may face.

Using Paytm from the USA opens up a world of opportunities, with the added benefit of exclusive deals, cashback offers, and low fees. Whether you need to make a payment, shop online, or transfer funds, Paytm ensures a smooth and efficient experience.

With Paytm’s user-friendly interface, secure transactions, and reliable customer support, you can confidently explore all that Paytm has to offer. Sign up today and start enjoying the convenience, benefits, and savings that Paytm brings to your financial transactions.

Summary of key points for using Paytm from the USA

When using Paytm from the USA, there are several key points to keep in mind. Firstly, setting up a Paytm account is easy and can be done by following the step-by-step guide provided. Make sure to verify your account and link your preferred payment methods for a seamless experience.

Once your account is set up, you can explore and take advantage of Paytm’s various features and services. Paytm offers convenient bill payment options, online shopping, and easy fund transfers, allowing you to handle all your financial needs in one place. Additionally, Paytm’s rewards and cashback system provide an opportunity to save money on your transactions.

To ensure secure transactions on Paytm, it is important to follow certain measures. Regularly update your password and enable two-factor authentication for added security. Paytm also provides features like personalized passcode and fingerprint authentication for enhanced protection.

If you encounter any issues or have questions regarding your Paytm account, their customer support is readily available to assist you. You can easily reach out to them for queries, assistance, or to resolve any problems you may face.

In conclusion, using Paytm from the USA offers a range of benefits, including exclusive deals, cashback offers, and low fees. By following the provided guide, utilizing the features, and ensuring the security of your transactions, you can fully enjoy the convenience and savings that Paytm brings to your financial transactions. Sign up today and experience a smooth and efficient way to handle your finances.

Additional resources and tips for maximizing Paytm’s benefits

To make the most out of your Paytm experience and maximize the benefits it offers, here are some additional resources and handy tips to consider:

- Paytm Blog and Social Media: Explore the Paytm blog and their social media channels to stay updated on the latest features, promotions, and tips. The blog offers valuable insights into how to use Paytm effectively and take advantage of its various features.

- Cashback Offers: Keep an eye on Paytm’s cashback offers that are regularly updated on their website and app. These offers can help you earn cashback on your transactions, saving you money in the process.

- Paytm First Points: Paytm First Points is a loyalty program that rewards you for using Paytm services. Earn points on every transaction and redeem them for exclusive discounts, deals, and rewards.

- Refer and Earn: Invite your friends and family to join Paytm using your referral link and earn rewards for every successful referral. This is an excellent way to earn additional cashback and discounts.

- Paytm Payments Bank: Consider opening a Paytm Payments Bank account for added benefits. It provides features like zero balance accounts, virtual debit cards, and attractive interest rates.

- Paytm Merchant Account: If you run a business, setting up a Paytm Merchant Account can streamline your payment process and provide additional benefits like quick payment settlements and access to business tools.

- Paytm Travel: Explore Paytm’s travel section for booking flights, hotels, and bus tickets. You can find attractive deals and discounts specifically designed for travelers.

By utilizing these additional resources and following these tips, you can enhance your Paytm experience and make the most of the benefits it offers. So start exploring, saving, and enjoying a seamless and convenient way to manage your financial transactions with Paytm.